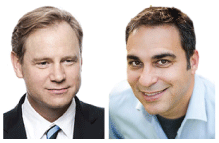

Two high-profile venture capital investors, Adam Lilling and Jim Flynn, will share top billing as the featured keynote speakers at this year’s Michigan Growth Capital Symposium on May 17 and 18. Coming from markedly different personal and professional backgrounds, the two top-performing VCs will provide insights into their carefully honed investment styles and strategies, and offer tips on the industry sectors, syndication partners and exit options and timing that deliver the best long-term results.

“Adam and Jim are Ross School graduates who represent success in venture capital investment fields that are central to our Michigan opportunity set: Internet services and health care,” says Professor David Brophy, MGCS founder and director of the U-M Center for Venture Capital and Private Equity Finance.

“Adam and Jim are Ross School graduates who represent success in venture capital investment fields that are central to our Michigan opportunity set: Internet services and health care,” says Professor David Brophy, MGCS founder and director of the U-M Center for Venture Capital and Private Equity Finance.

On Tuesday at noon, Lilling, the founder of PLUS and the managing partner of the venture fund Plus Capital, will tell how he manages venture-capital investing, equity-driven partnerships and start-up operations for Hollywood’s rich and famous. More than a dozen top celebrities have engaged Lilling to put their time, money, brand and social network into play at high-potential private companies throughout the business growth cycle. A 1992 Michigan Ross graduate, Lilling sharpened his investment instincts and skills by spending two decades in the trenches as an Internet entrepreneur and startup innovator. He co-founded LaunchpadLA in 2009 to build Los Angeles’ “silicon beach” tech community and previously launched three startups, one with backing from Richard Branson and Virgin Entertainment Group.

On Wednesday morning, Flynn will recount his progression at Deerfield Management from 2000 when he joined the firm to the present. Starting with a focus on pharmaceutical companies, Flynn began co-managing Deerfield with founder Arnold Snider in 2004. After Snider’s retirement, Flynn assumed full oversight of investment activities and management of the company, which has offices in New York City, Shanghai and Switzerland. Since then, he has expanded Deerfield’s investment scope, developed the Deerfield Institute’s market research capabilities and created the Deerfield Foundation to benefit disadvantaged children. Flynn’s prior investment analytics experience at Alpharma Inc. and Kidder, Peabody & Co., and his business development activities at Furman Selz laid the foundation for his leadership role at Deerfield.

Making its debut this year at the symposium is the Michigan Venture Partnership, a high-powered networking initiative designed to promote greater connectivity and synergy among U-M alumni who invest across a variety of sectors. The partnership will kick off with a morning reception on Tuesday and feature comments about commercializing university research and inventions by experts from U-M Tech Transfer and Osage University Partners. “The symposium provides a natural gathering opportunity for the hundreds of U-M alumni who are investing in venture capital in all parts of the world and who are interested in the upside potential of our transformational research,” Brophy remarks.

Panel discussions, led by seasoned investors and entrepreneurs, will drill down on critical issues related to health-care innovation, medical software and other disruptive technologies. “Health care is a major global investment area,” Brophy remarks. “Here in the Michigan and the Midwest, we have the hospital systems, research universities, talent pool and venture funds that can give us an edge over other parts of the country. We need to work at what we’re good at.”

Many of the Great Lakes region’s most promising entrepreneurial companies will showcase their products and services during formal presentations to angel and venture capital investors at the symposium. Technology-transfer specialists from seven leading Midwestern research universities also will give previews of exciting ventures emerging from their institutions during the third annual University Research Pitch Track.

“The Michigan Growth Capital Symposium, the original venture fair, now in its 35th year and emulated globally, continues to fuse finance, entrepreneurship and economic growth for the betterment of all,” Brophy concludes.

To learn more about MGCS or to register, visit www.Michigan-GCS.com. Follow conversations surrounding the symposium through #MGCS2016 on Twitter.