Written by: Nick Capaldini, Co-Founder at BikeMesh AI | Master of Science ‘22

I attended the Zell Alumni Summit, a two-day event for entrepreneurial alumni from the University of Michigan. It was an inspiring experience, and I wanted to share the insights I gained. The central themes that emerged from the sessions, networking, and conversations were captured in three main ideas: Community, Cash, and Trompe-l’œil—each representing a unique approach that sets Michigan’s entrepreneurial culture apart.

Community: The Power of Shared Purpose

One of the most powerful themes at the summit was the idea that a startup is, at its heart, a startup is a community—a unified group bound by a shared mission. During the summit, many speakers returned to the importance of fostering community both within and around a startup. Sam Zell’s insights in his book Am I Being Too Subtle? resonated strongly; he emphasized that it’s not only about the immediate deals but about building enduring relationships that create a stable foundation for future growth.

Building a strong community around your business requires empathy and a deep understanding of your customers, investors, and team members. Companies we met like Breadless and Detroit City FC exemplify this—they’ve cultivated loyal communities that feel deeply connected to their missions. Customers want to feel like part of your company, and in some cases, they become integral advocates or contributors.

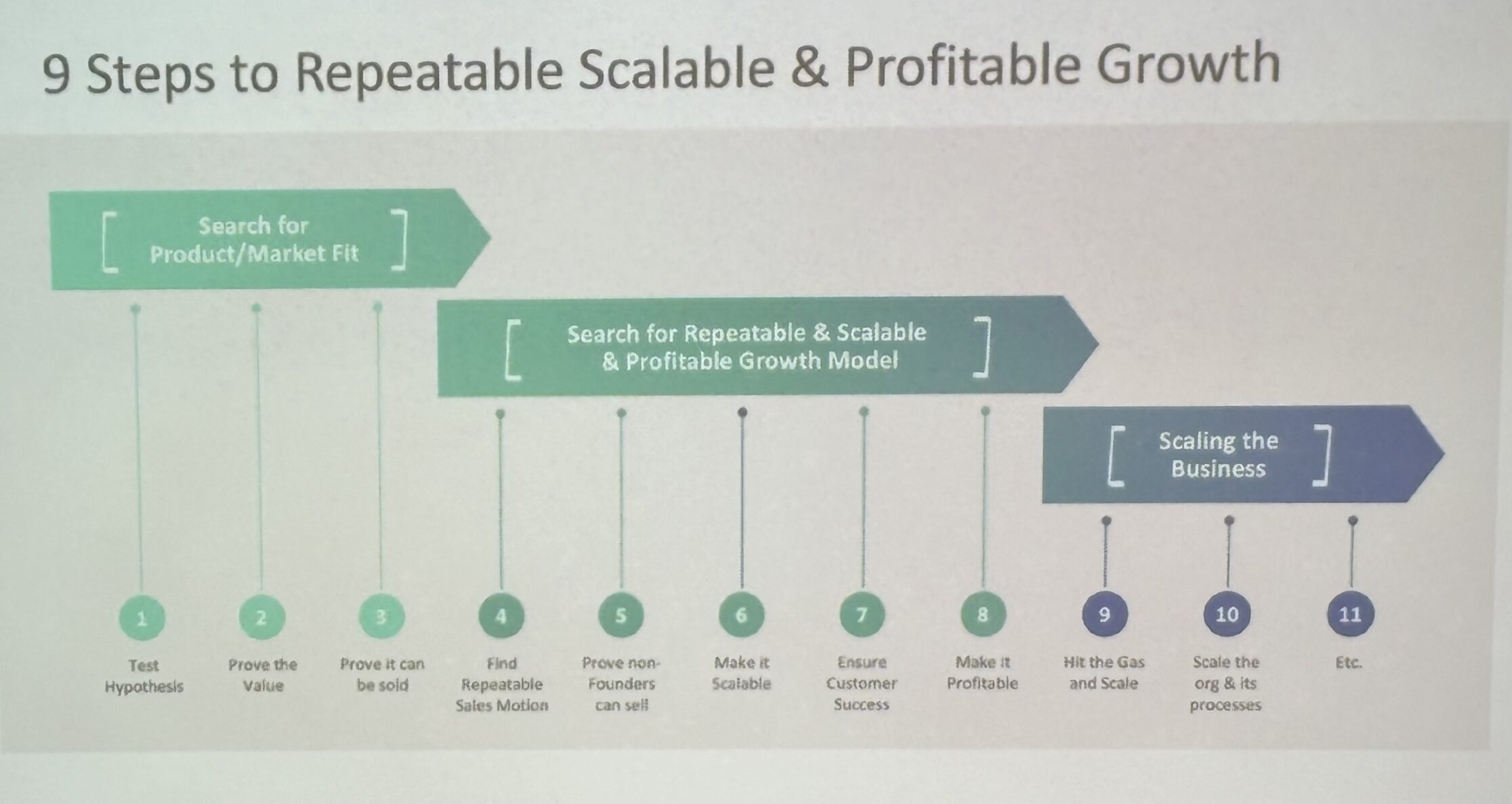

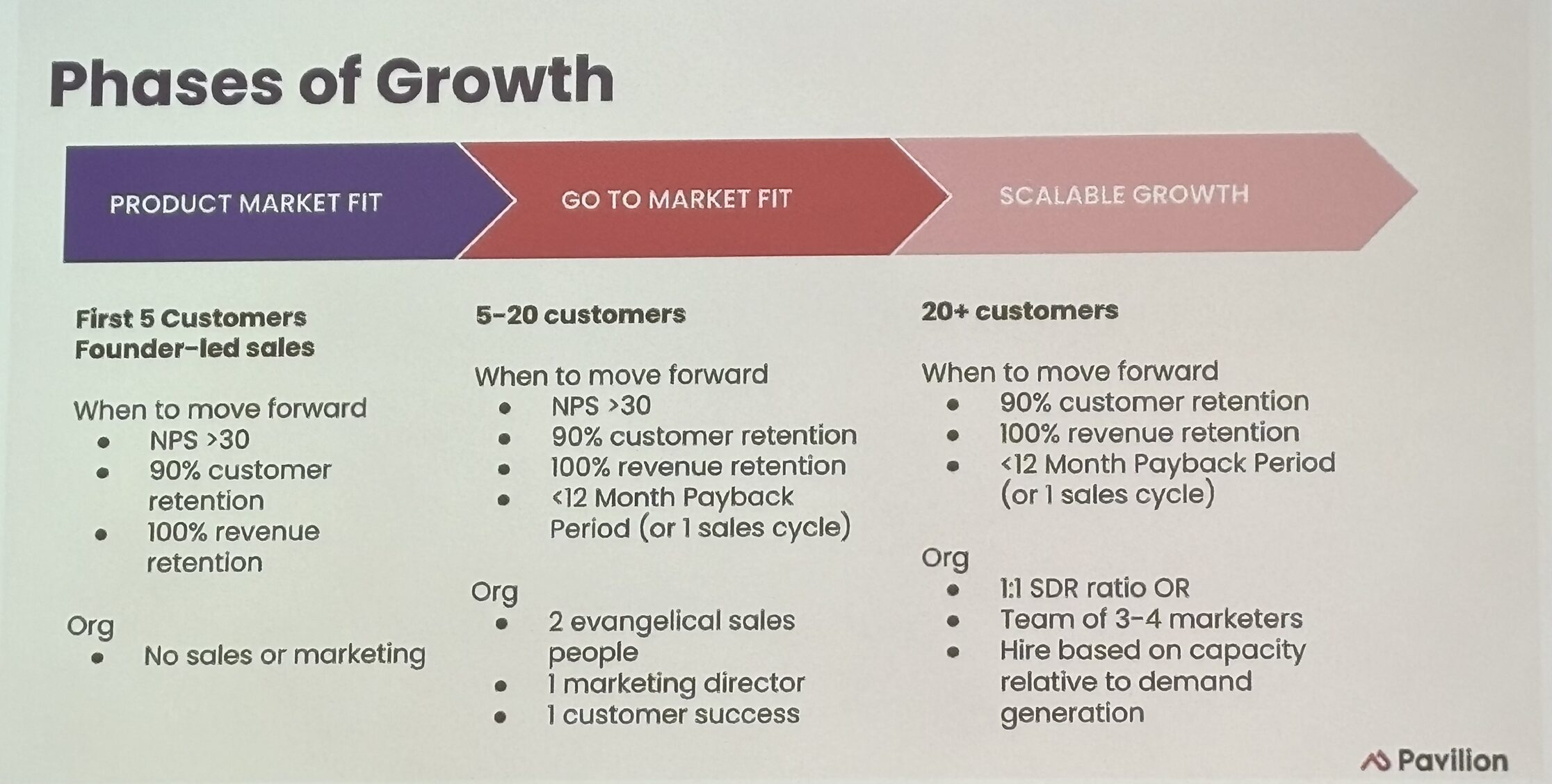

This emphasis on empathy underscored the idea of “product/market fit,” and the idea of fitting into and becoming part of a community rather than observing from a distance.

Effective startups listen closely to their customers’ needs, understand what they value, and even join them in shared experiences.

For myself, this means I need to strengthen my ties within my professional community to better serve them.

Beyond customer understanding, we discussed practical methods to grow your community through different phases. LinkedIn engagement, leveraging video, hosting informational sessions and conferences, co-branding efforts, and trade show participation are powerful tools. Each interaction should create a memorable touchpoint, whether it’s a professional testimonial, branded content, or even a physical presence at an event.

Tactical Takeaways for Community:

- Read The Only Thing That Matters by Marc Andreessen

- Community Discovery > Identify a clear niche for your startup and engage directly with that community through industry events, co-branding efforts, or in-person interactions like trade shows

- Community Building

- Develop a compelling company story that includes your mission, core values, and why you exist beyond making a profit

- Use content marketing, such as educational videos, LinkedIn engagement, and direct interactions like office hours, to foster ongoing dialogue with your audience

- Solicit testimonials early and often from your customers, especially those who are vocal advocates of your product

Cash: De-Risking for Investment

The adage “cash is king” couldn’t have been more relevant at the summit. Speakers emphasized that, while visionary ideas are critical, cash flow is what keeps a business alive and credible. Interestingly, while leading the fundraising session venture capitalist Liat Aaronson noted that nearly 80% of the companies she has seen receive recent investments had revenues, highlighting the value of proving a business model before seeking major funding.

For many startups, de-risking through cash flow and revenue is the best strategy to attract investment. Breadless and Detroit City FC again served as prime examples: Breadless gained much of its funding from early-stage funds. Detroit City FC on the other hand ran a successful crowd-investing campaign through WeFunder. While these companies each approached funding differently, both prioritized showing revenue and gaining traction. We were advised that regardless of whether you chose to bootstrap, generating profits and maintaining lean operations should be top priorities.

Relationships are also essential. Many investors view their support as an ongoing relationship, not a one-time transaction. This is further examined in Mark Suster’s article Invest in Lines, Not Dots.

The only thing that is more important than the investor’s relationship with the start-up is the makeup of the founding team itself.

This was reiterated by Liat and also tracks with recent research out of Stanford’s School of Business’s Venture Capital Initiative: According to a survey of over 500 venture capitalists, a startup’s founding team is considered the most significant predictor of long-term success.

Start-up Success Factors. Credit Illya Strebulaev

For entrepreneurs who prefer alternatives to venture capital, many diverse options were recommended, including crowdfunding, grants, and Small Business Associations’s 7A loans. The key is to find funding sources that align with the company’s goals and vision for growth.

Tactical Takeaways for Securing Funding:

- Read Invest in Lines, Not Dots by Mark Suster

- Focus on getting an initial set of paying customers before seeking major investment

- Be prepared for rejections—expect at least 100 “no’s” before landing a major investment deal

- Explore various funding options that fit your company’s stage and growth goals, from venture capital to crowdfunding and small business loans

- For funding: Arbor Street, Wolverine Ventures, and University of Michigan Ventres

- For crowd investment: WeFunder

- For loans: Small Business Associations’s 7A Loans

- For local or state grants: Motor City Match

- Build strong, ongoing relationships with investors — they want to see you grow and succeed, not just take their money and run

Trompe-l’œil: Crafting Perception Without Overspending

The concept of trompe-l’œil, or “deceiving the eye,” came up during a tour of Michigan Central Station and provided an unexpected but valuable metaphor. In the station, many of the ornamental designs that appear to be marble or wood are actually cleverly crafted plaster. This effect creates the look and feel of high-end materials without the associated cost or time, making the station feel grander than its budget allowed.

Trompe-l’œil ram appears as carved wood but is molded plaster

Trompe-l’œil ceiling appears as marble but is textured plaster

In startups, trompe-l’œil is about delivering the experience or perception that customers love—without overspending. This idea is further discussed in Jason Cohen’s article Your customers hate MVPs. Make a SLC instead. Detroit City FC demonstrated this by fielding top college players as stand-ins for professionals in their early seasons, creating the effect of a professional team on a limited budget.

The lesson is clear: focus on proving your concept with a resourceful baseline solution customer love, rather than overbuilding before customers have even validated the product.

Too often, entrepreneurs get caught up in “marble ceilings” when a well-crafted “plaster” solution that feels like marble would have been enough to prove the concept. This principle reminded me that, especially early on, finding efficient ways to achieve customer satisfaction can be the key to rapid growth and long-term success.

Tactical Takeaways for Efficient Growth:

- Focus on creating a simple, lean version of your product that solves a specific customer problem

- Think resourceful, not extravagant – find creative ways to make your product or service feel high-end without the associated costs

- Test and iterate early, using minimal resources to prove that your concept works and resonates with your target audience

The University of Michigan’s Zell Alumni Summit offered invaluable insights and a sense of pride in being part of a unique entrepreneurial community. Reflecting on Community, Cash, and Trompe-l’œil, I left with a stronger understanding of the Michigan approach to building sustainable, impactful companies. This approach prioritizes people and relationships, pragmatic financial growth, and creativity in problem-solving—tools that I am eager to apply in my ventures.

Whether through building community, securing cash flow, or finding innovative ways to achieve great results, Michigan entrepreneurs have a roadmap to success that’s as resourceful and resilient as it is ambitious. And after the summit, I’m more motivated than ever to carry those principles forward.